Projected Trends in the Global Wood Veneer Industry for 2025

The Veneer View: Innovation and Sustainability Define the Wood Veneer Industry in 2025

GLOBAL MARKET – As the world steps firmly into 2025, the global wood veneer industry, a critical nexus between raw forestry and high-design finished goods, is undergoing a profound transformation. No longer just a traditional material sector, it is rapidly evolving into a beacon of sustainability, technological integration, and consumer-conscious innovation. Driven by a potent mix of environmental imperatives, digital advancement, and shifting aesthetic demands, the wood veneer market is positioning itself for a year of robust growth and strategic reinvention.

The Sustainability Imperative: Beyond a Selling Point to a Core Operational Principle

The most powerful force shaping the industry in 2025 is the unabated and intensifying focus on sustainability. This is no longer a niche concern but a fundamental market driver influencing every step of the value chain, from forest to showroom.

Certification as a Baseline: Certifications like FSC (Forest Stewardship Council) and PEFC (Programme for the Endorsement of Forest Certification) have moved from a competitive advantage to a non-negotiable entry ticket for major B2B and B2C contracts. Corporate sustainability mandates and consumer demand for ethically sourced products are enforcing this shift. In 2025, transparency is key; companies are increasingly utilizing blockchain technology to provide end-to-end traceability, allowing a designer in Milan to verify the exact sustainable forest in Finland where the veneer for their luxury table originated.

The Rise of Engineered and Alternative Veneers: The industry is brilliantly addressing the dual challenge of preserving old-growth forests and meeting demand for rare species. Engineered veneers, which reconstruct less popular or fast-growing species to mimic the aesthetic of rare woods, are experiencing double-digit growth. Furthermore, the market for veneers made from reclaimed wood—sourced from decommissioned barns, industrial buildings, and even sunken logs recovered from riverbeds (“sinker wood”)—continues to boom, adding a story of authenticity and eco-consciousness that resonates powerfully with consumers.

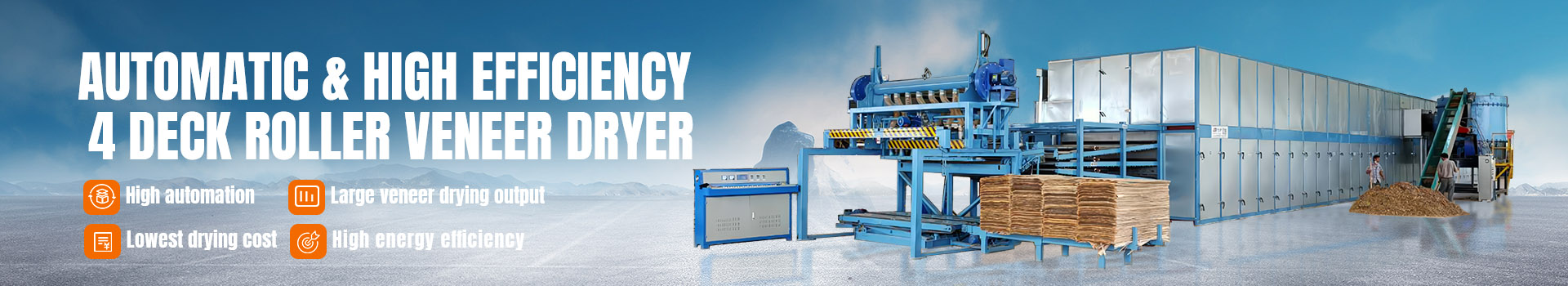

Efficiency and Waste Reduction: Modern production facilities are models of efficiency. Advanced scanning and cutting technologies maximize yield from each log. Meanwhile, what was once considered waste—sawdust and small off-cuts—is now seen as a valuable resource. It is being compressed into biomass pellets to power the very factories that produce the veneer, creating closed-loop systems, or used in the creation of composite materials, moving the industry closer to a zero-waste ideal.

Technological Revolution: Precision, Customization, and Digital Integration

Technology is the great enabler of 2025's trends, revolutionizing how veneer is produced, sold, and applied.

AI and Optical Scanning: Artificial Intelligence has become integral to grading and sorting. High-resolution optical scanners, powered by sophisticated AI algorithms, can assess each sheet of veneer for grain pattern, color consistency, and defects with inhuman accuracy and speed. This ensures perfect matching for large projects and allows for highly precise grading, maximizing the value of each flitch.

Digitalization of Sales and Design: Augmented Reality (AR) and high-fidelity 3D modeling have transformed the specification process. Architects and designers can now visualize exactly how a specific veneer, with its unique grain and figure, will look on a full wall or a piece of furniture within a digital twin of the actual space. This reduces material sampling, shortens decision cycles, and minimizes the risk of costly missteps. Online platforms have become sophisticated marketplaces, offering vast digital libraries of available veneers from suppliers across the globe.

Advanced Finishing and Treatment: Finishing technologies have made leaps in durability without sacrificing aesthetics. UV-cured and ceramic-based coatings provide exceptional resistance to scratches, stains, and fading from UV light. These advancements are opening new applications for veneer in high-traffic commercial spaces, healthcare facilities, and even marine interiors, areas once dominated by plastics and laminates.

Market Dynamics: Evolving Demand and Global Supply Chains

The end-market demand for veneer is shifting, reflecting broader economic and cultural trends.

The Strength of Commercial and Hospitality Sectors: While the residential furniture market remains strong, the most significant growth is emanating from the commercial interior design sector. Companies investing in their office spaces post-pandemic are prioritizing biophilic design—incorporating natural elements like wood to enhance well-being, reduce stress, and improve productivity. Veneer, as a cost-effective and sustainable way to bring warm, natural wood into large spaces, is a primary beneficiary. Similarly, the luxury hospitality sector continues to be a major consumer, using veneers to create unique, authentic, and Instagram-worthy environments.

Geographical Shifts: Asia-Pacific, particularly China and India, remains a powerhouse of both consumption and production. However, there is a notable trend towards regionalization of supply chains. Geopolitical uncertainties and a desire to reduce carbon footprints associated with long-distance shipping are prompting North American and European manufacturers to source more locally or from politically stable regions. This is bolstering the forestry and manufacturing sectors in Eastern Europe and South America for the Western markets.

The Luxury Factor and Customization: In the high-end market, veneer is celebrated for its uniqueness. The ability to provide one-of-a-kind, book-matched panels with dramatic grain patterns is a key value proposition. The demand for customization is at an all-time high, with clients seeking specific cuts, species, and finishes to create truly bespoke interiors.

Challenges on the Horizon

Despite the optimistic outlook, the industry navigates a complex landscape of challenges in 2025.

Logistics and Cost Volatility: Global shipping, while more stable than in the immediate post-pandemic years, remains a source of potential disruption and cost fluctuation. The industry must maintain agile logistics strategies to mitigate these risks.

The Skilled Labor Gap: As machinery becomes more advanced, the need for highly skilled technicians to operate and maintain it grows. Simultaneously, the traditional art of veneer splicing, matching, and hand-application risks being lost as an older generation of artisans retires. A major industry focus is on attracting new talent and establishing robust training programs to bridge this gap.

Greenwashing Scrutiny: As sustainability claims multiply, so does scrutiny from regulators and consumers. Companies must be prepared to substantiate every environmental claim with hard data and transparent practices to avoid accusations of greenwashing, which can be devastating to brand reputation.

Looking Ahead: An Industry in Bloom

In conclusion, 2025 is poised to be a landmark year for the wood veneer industry. It has successfully pivoted from being a supplier of a commodity product to a purveyor of a sophisticated, sustainable, and technology-driven design solution. By embracing its role at the intersection of nature and innovation, the industry is not just growing; it is enhancing its value proposition, ensuring its relevance for architects, designers, and consumers who seek beauty, authenticity, and a clear conscience in the materials that surround them. The future, much like the finest figured veneer, appears rich, complex, and full of character.