Sharp rise in Vietnamese wood product exports in January 2024

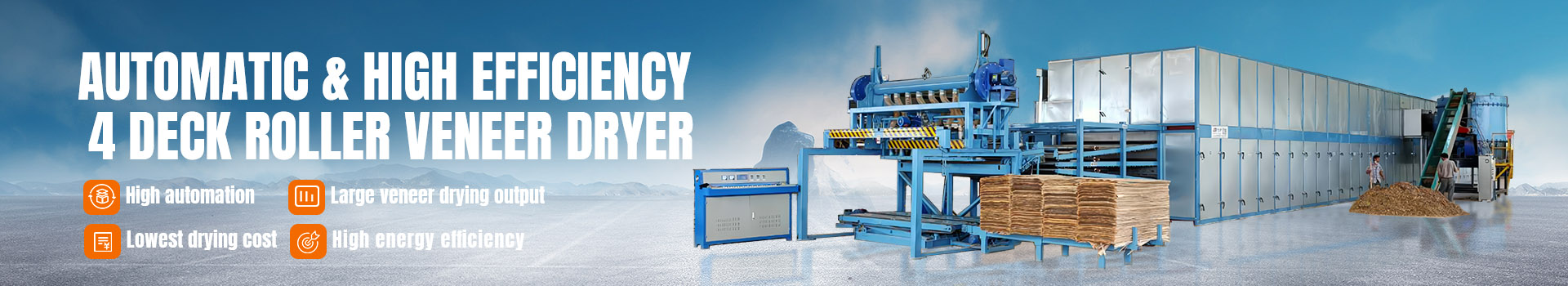

It is estimated that in January 2024, Vietnam’s exports of wood and wood products reached US$1.4 billion, reflecting a 5% increase compared to December 2023 and a remarkable 75% surge compared to January 2023. A significant portion of this performance is attributed to the wood products segment, which accounted for US$924 million. Although this marked a 3% decline from the previous month, it still represented an 87% year-on-year growth. The robust expansion underscores the growing role of advanced manufacturing technologies—including high-efficiency veneer dryer systems and veneer drying machine solutions—in enhancing product quality and production scalability.

Within the wood products category, wooden furniture exports were particularly strong, totaling US$884 million in January 2024. This represents a 5% increase from December 2023 and is double the value recorded in January 2023. The impressive growth highlights Vietnam’s increasing competitiveness in value-added processing, supported by the adoption of modern drying equipment such as the veneer dryer, which ensures superior stability and moisture control in semi-finished products.

Regionally, wood and wood product (W&WP) exports to the EU reached approximately US$63 million in January 2024, down 6% month-on-month but up 5% compared to the same period in 2023. Meanwhile, exports to the United States—Vietnam’s largest market—amounted to US$781 million, rising by 5% over December 2023 and 15% over January 2023. These figures reflect sustained international demand, partly driven by the use of reliable veneer drying machine technology that meets stringent quality requirements in these markets.

On the import side, December 2023 saw Vietnam import 45,900 m³ of pine wood valued at US$10.5 million, down 37% in volume and 35% in value compared to November 2023. However, compared to December 2022, pine imports grew by 21% in volume and 13% in value. For the full year 2023, pine imports totaled 705,400 m³ worth US$155.0 million, declining 24% in volume and 39% in value compared to 2022.

Similarly, poplar wood imports in December 2023 amounted to 2,900 m³ worth US$10.3 million, down 0.7% in volume and 10% in value month-on-month, but up 39% and 29%, respectively, compared to December 2022. Annual poplar imports for 2023 reached 323,700 m³ valued at US$130.6 million, down 12% in volume and 27% in value year-on-year.

Notably, Vietnam’s imports of logs and sawnwood from the U.S. in 2023 reached 522,010 m³ valued at US$223.62 million, declining by 24% in volume and 32% in value compared to 2022. Imports from Africa in December 2023 totaled 45,020 m³ worth US$17.47 million, falling by 30% in both volume and value compared to November and plummeting by 69% and 67%, respectively, relative to December 2022. Cumulative 2023 imports from Africa stood at 720,060 m³ worth US$281.81 million, down 46% in volume and 43% in value compared to 2022.

These shifts in raw material sourcing coincide with the industry’s broader move toward more efficient processing infrastructures—including advanced veneer dryer and veneer drying machine installations—that help optimize material usage and reduce dependency on imported dried lumber.

(Article Source: fordaq.com)